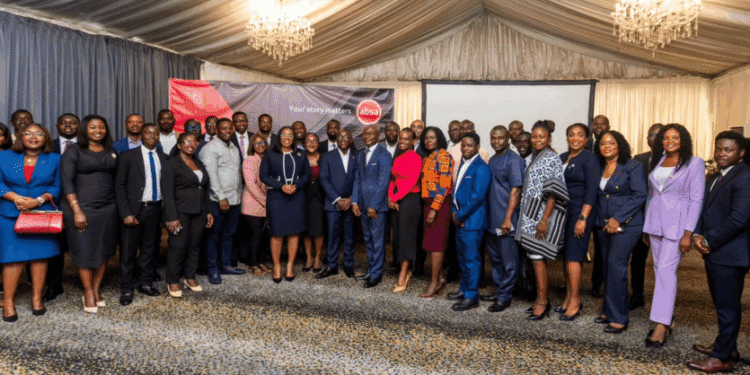

Absa Bank Ghana has called on corporate institutions to take advantage of Ghana’s growing debt-capital markets as a credible and sustainable source of long-term funding, describing it as an essential complement to traditional banking solutions at a time when Ghana’s economy shows renewed stability and investor confidence. The call was made at the bank’s Debt Capital Markets (DCM) Funding Workshop in Accra, which brought together regulators, institutional investors and corporate leaders to discuss practical strategies for unlocking new financing opportunities through notes, bonds and commercial paper.

Held under the theme “Unlocking Debt Capital Markets Financing: Diversifying Funding Sources for Competitive Advantage,” the event drew participation from the Securities and Exchange Commission (SEC), the Ghana Fixed Income Market (GFIM) and the Ghana Stock Exchange (GSE), among others. Delivering the opening remarks, Dr Ellen Ohene-Afoakwa, Managing Executive for Corporate and Investment Banking at Absa Bank Ghana, said that a strengthening macro environment and improving market confidence present a timely opportunity for businesses to diversify their funding sources through well-structured capital-market instruments. “Corporate funding is moving beyond traditional bank lending. The capital market offers a credible, complementary avenue for businesses to diversify their funding sources, and Absa Bank stands ready to connect issuers and investors through expert advisory and innovative solutions,” she said. Dr Ohene-Afoakwa noted that with Ghana’s fund-management industry now managing assets of approximately GHS 93 billion (SEC Q2 2025), there is significant local liquidity that can be channelled into productive sectors.

Speaking on behalf of the Ghana Fixed Income Market, Mr Augustine Simons commended Absa for its role in promoting market education as fixed-income activity continues to strengthen. He reported that since its establishment in 2015, the market has recorded more than GHS 1 trillion in cumulative trading volume and over GHS 24 billion in corporate issuances. By September 2025, traded volume had already reached GHS 185 billion, with projections of up to GHS 250 billion by year-end.

“The market is ready for more corporates to take advantage of its liquidity and transparency,” he said. “Over the next decade, GFIM’s focus will be on expanding the corporate-bond segment through sustainability, digital innovation and regional integration, positioning Ghana as a capital-market hub in Africa. Representing the Securities and Exchange Commission, Mr Macnamara Peter-Brown outlined the regulatory framework supporting Ghana’s debt-capital-market operations, emphasising the SEC’s work to reinforce market integrity and investor confidence. He cited the Securities Industry Act 2016 (Act 929), the Companies Act 2019 (Act 992) and the Corporate Bond Issuance Guidelines as key instruments governing market operations, alongside policy initiatives such as the Capital Market Master Plan and Time with the SEC investor-education series.

“Compliance lies at the heart of market confidence. Our role as regulator is not to impose hurdles but to protect investors, sustain transparency and ensure that issuers raise funds responsibly,” he said.

Mr Peter-Brown added that corporate-bond funding currently accounts for about 1 per cent of Ghana’s GDP, compared with 45 per cent in the United States, underscoring the opportunity to deepen domestic corporate issuance to support private-sector expansion. Analysts at the event observed that Absa’s initiative aligns with the broader improvement in market conditions, highlighting how effective capital markets can reduce dependence on bank lending, lower financing costs and match long-term investment with sustainable funding options. The workshop concluded with a call for closer collaboration among issuers, arrangers, regulators and investors to build a resilient ecosystem that supports Ghana’s development agenda. “At its core, this is about partnership,” Dr Ohene-Afoakwa said in closing. “By connecting corporate ambition with investor capital, we can unlock funding that drives economic growth and empowers Africa’s tomorrow, together.” The Absa DCM Funding Workshop forms part of the bank’s continuing commitment to deepening market participation and advancing Ghana’s capital-market maturity through knowledge sharing, advisory excellence and collaborative engagement.

Disclaimer: The content provided on Fish FM Online is for informational and entertainment purposes only. While we strive for accuracy, we do not guarantee the completeness, reliability, or timeliness of the information presented. Fish FM Online and its affiliates are not responsible for any errors or omissions, nor for any decisions made based on the content available on our platform.