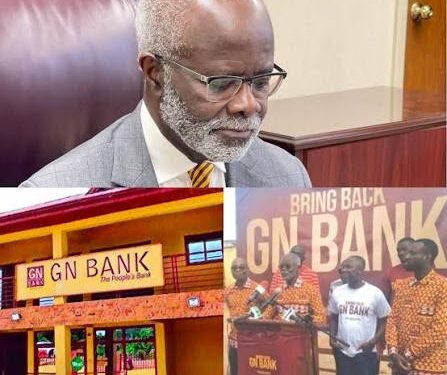

Group Nduom has rejected claims that the Bank of Ghana (BoG) has conclusively ruled out the restoration of GN Bank’s operating licence, describing such reports as inaccurate and misleading.

In a statement issued on Friday, February 6, 2026, the group said its attention had been drawn to a publication by the Daily Graphic suggesting that the central bank had firmly closed the door on any licence restoration for GN Bank.

According to Group Nduom, GN Bank Limited was reclassified as a savings and loans company on January 4, 2019, and subsequently renamed GN Savings and Loans Company Limited. However, just seven months later, on August 16, 2019, the Bank of Ghana revoked the company’s operating licence and appointed Mr Eric Nana Nipah as Receiver.

The revocation formed part of the banking sector clean-up exercise initiated by the former Minister of Finance, Ken Ofori-Atta, in 2018.

Group Nduom said the owners of GN Savings and Loans, led by Dr Papa Kwesi Nduom, challenged the revocation at the High Court in Accra on August 30, 2019. After nearly five years, the High Court, presided over by Justice Gifty Agyei Addo, ruled in favour of the Bank of Ghana on January 24, 2024.

Dissatisfied with the decision, the owners filed an appeal at the Court of Appeal on January 29, 2024. The appeal remains pending and is scheduled to be heard on February 10, 2026.

The group further disclosed that although the Bank of Ghana has been duly served with all appeal documents, it has yet to file a substantive response, only submitting an application for extension of time last week.

Group Nduom also clarified that the Supreme Court has not ruled on the revocation or restoration of GN Savings and Loans’ licence, contrary to claims in the publication.

It explained that the only matter that reached the Supreme Court was an interlocutory application on the jurisdiction of the High Court, which was decided in favour of the owners of GN Savings and Loans.

The group assured the public of its commitment to protecting its legal rights and safeguarding the interests of its customers as the case continues.