Parliament has approved the Value Added Tax(VAT) Bill 2025, aimed at undertaking comprehensive tax reforms to enhance clarity, consistency, and legal certainty in the country’s VAT regime.

The new bill seeks to replace the current flat-rate system with a single, coherent structure.

It also introduces a provision to increase the registration threshold for VAT-eligible businesses, a move expected to exempt many micro and small enterprises from VAT obligations.

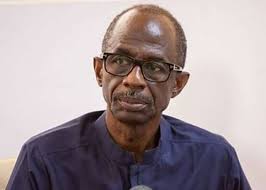

However, debating the motion, the Minority Leader, Alexander Afenyo-Markin, cautioned that the revised VAT framework could impose additional taxes on businesses and place a additional burden on the general public.

The Deputy Finance Minister, Thomas Nyarko Ampem, however, rejected the claim, insisting that the new VAT framework will simplify compliance rather than impose additional tax burdens on businesses or the public.